Research

Conference “The French digital assets sector in 2020”

On June 2nd, Adan organised a web conference on the digital asset industry in 2020. This event analysed and transcribed data from our latest survey report on the state of play and development prospects of the cryptoasset and blockchain technology industry.

The speakers at this conference were Faustine Fleuret (President and CEO, Adan), Jules Dubourg (Administrative and Financial Manager, Adan) and Hugo Bordet (Policy Officer, Adan).

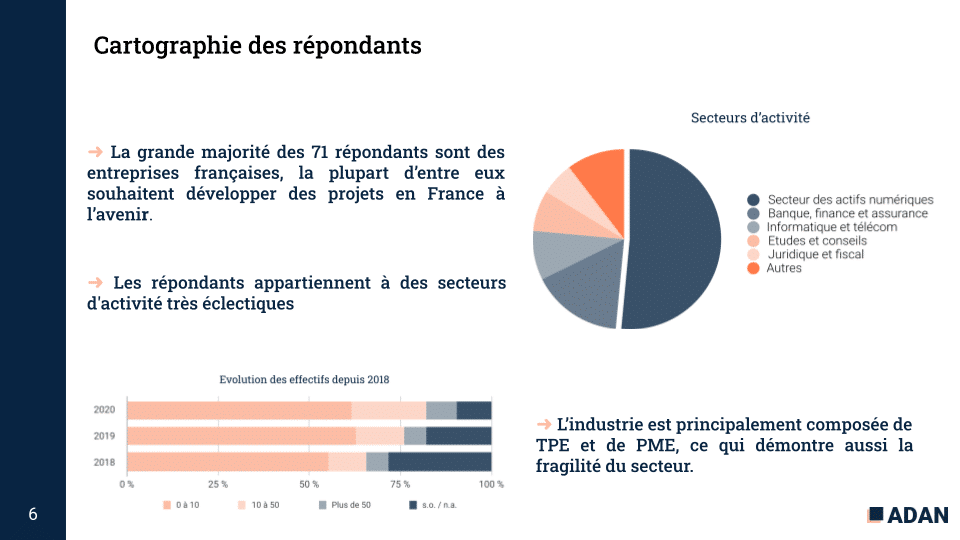

After a short introduction to the conference, Hugo Bordet presented a mapping of the different members of the crypto assets industry.

This mapping has highlighted the diversity of the cryptoasset industry and the fragility of a still-developing sector. Indeed, most of the companies in the sector are VSEs or SMEs (only 8% of the industry’s members employ more than fifty people).

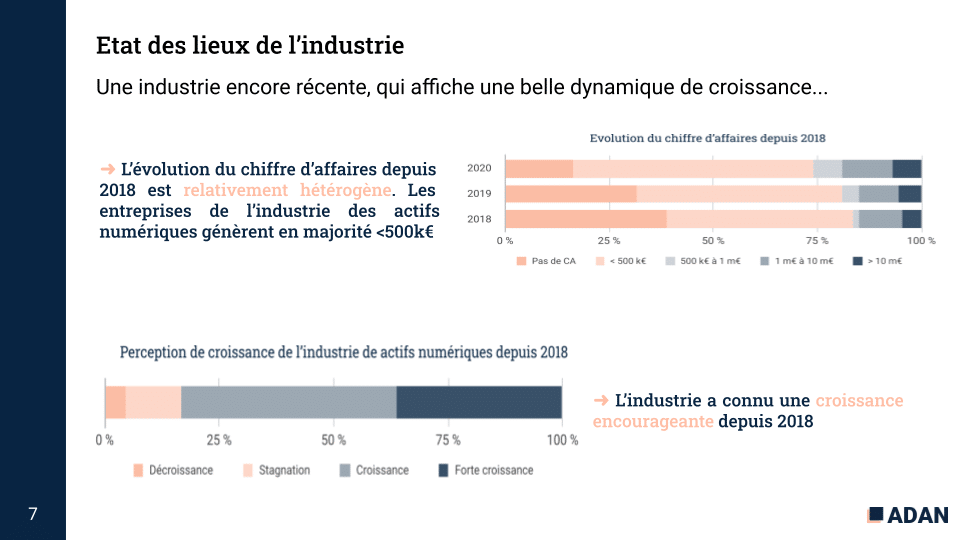

Following this mapping, Jules Dubourg gave an overview of the cryptoasset industry.

Despite a hostile economic context, the French industry continued to grow in 2020. Despite such growth, a low number of fundraisings were recorded by industry members.

In addition, the survey highlighted the significant (albeit minority) involvement of the state in the development of the sector.

Lastly, this inventory revealed the large share of DASPs in the sector (around 21%) and the diversity of services offered by these players. Most DASPs in France have obtained or are seeking registration with the AMF.

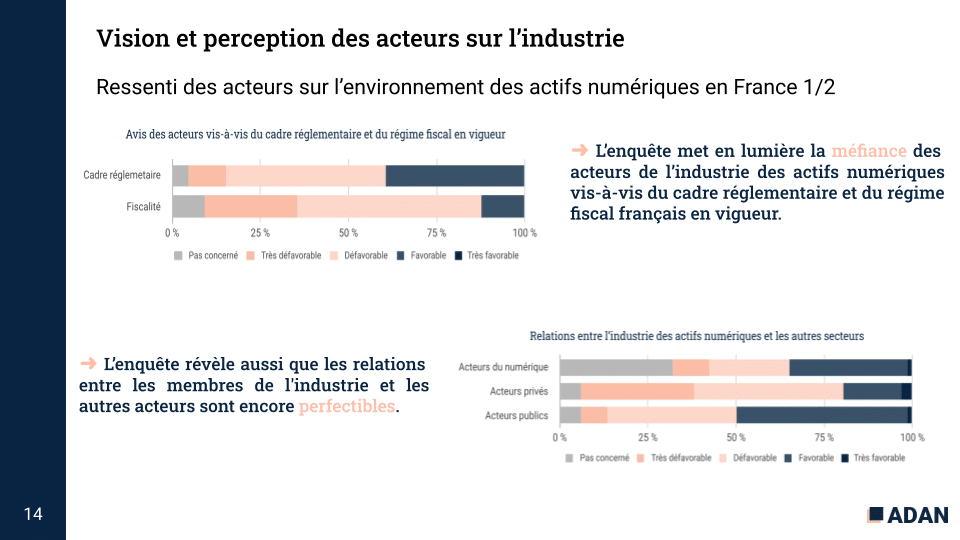

Hugo Bordet then gave the players’ feelings on the cryptoasset industry in France.

Despite a generally positive view of the market (most respondents to the survey have a favourable idea of the future of the market and 72% have plans to develop in France in the future), members of the industry have a primarily negative vision of the regulatory framework (the DASP regime and public offerings of tokens are considered too restrictive for some players), the tax system (sometimes incomprehensible and obsolete), and their relations with the other players (authorities, private players and big techs).

In addition, preconceived notions about crypto assets and the lack of funding for players hinder the development of companies in the sector.

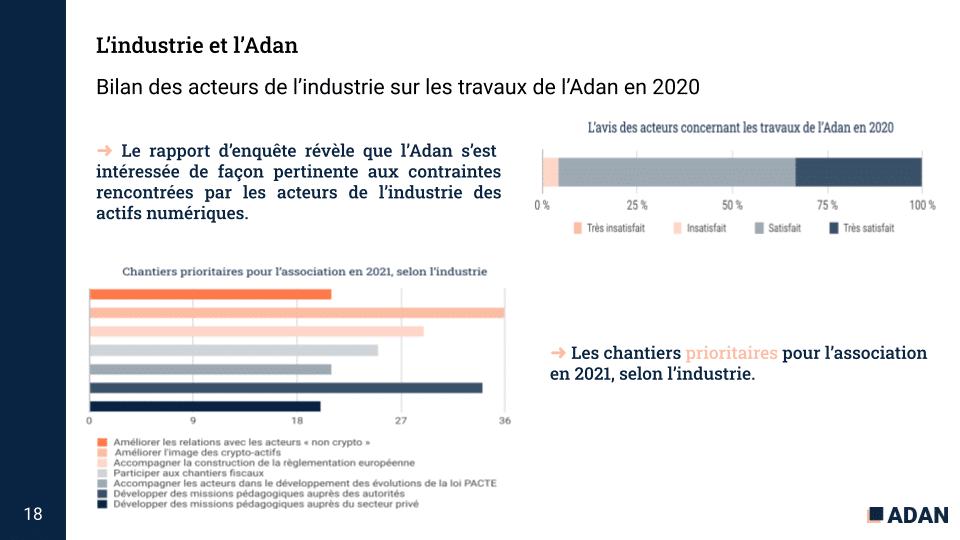

Finally, Jules Dubourg and Hugo Bordet explained the links between Adan and the members of the industry and an assessment of all the work carried out by the association to promote the development of the sector and the emergence of new players.

In summary, it appears that despite its youth, Adan has taken on most of the problems encountered by crypto companies in France. This is why the vast majority of industry members are satisfied with Adan’s work in 2020.

In this context, Faustine Fleuret presented Adan’s action plan for the coming years.

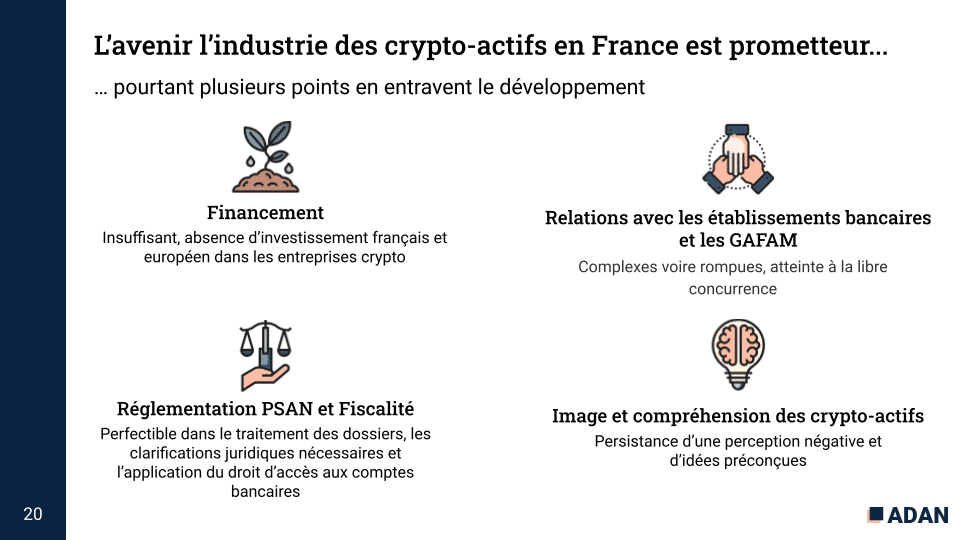

While the future of the cryptoasset sector is auspicious (given all of the above), some issues seem to be slowing its development.

This is why, in the future, it will be necessary to continue the work already started to strengthen investors’ understanding of the opportunities offered by crypto assets, to improve relations between crypto players and French banking institutions, to clarify the French regulatory framework and build a basis for objective and dispassionate discussions with non-crypto players.

A