Research

« Relax, take it easy » : Understanding the MiCA and Pilot Regime crypto regulation

During its webinar held on October 7, Adan presented and analysed the European Commission’s regulatory proposals applicable to “crypto-assets”, published as part of its Digital Finance Package on September 24. The Association also expressed its concerns about the potential threats these projects pose to innovation. Adan proposes solutions to improve these frameworks and thus promote the competitiveness of the European crypto industry.

Background

To stimulate innovation while preserving financial stability and protecting crypto-assets users, the European Commission unveiled its proposed framework for crypto-asset markets, based on two draft regulations – an opportunity to clarify the legal framework applicable to industry players.

The Commission’s two regulatory proposals are part of its Digital Finance Package and, more broadly, of its 2018 FinTech Action Plan. In particular, the Commission has organised public consultations with stakeholders to prepare these drafts. Adan had the opportunity to respond to two consultations: one on the framework applicable to the crypto-assets markets, the other on the FinTech action plan.

Regulation

The European Commission’s proposal for the regulation of crypto-assets markets is based on two draft texts :

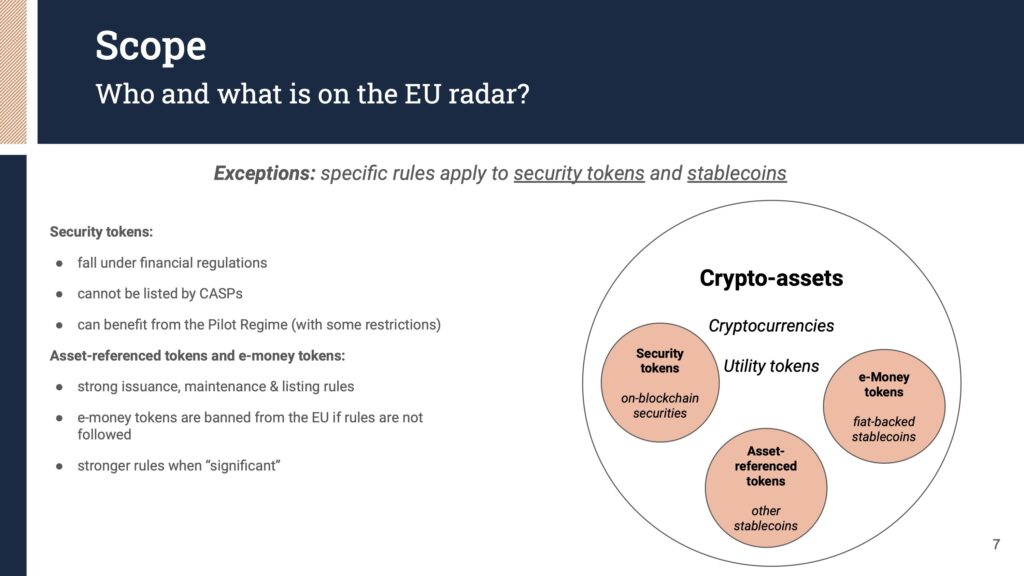

- MiCA (Markets in Crypto-Assets Regulation) whose scope covers cryptocurrencies, utility tokens and stablecoins ;

- the Pilot Regime Regulation for DLT Market Infrastructures (PRR).

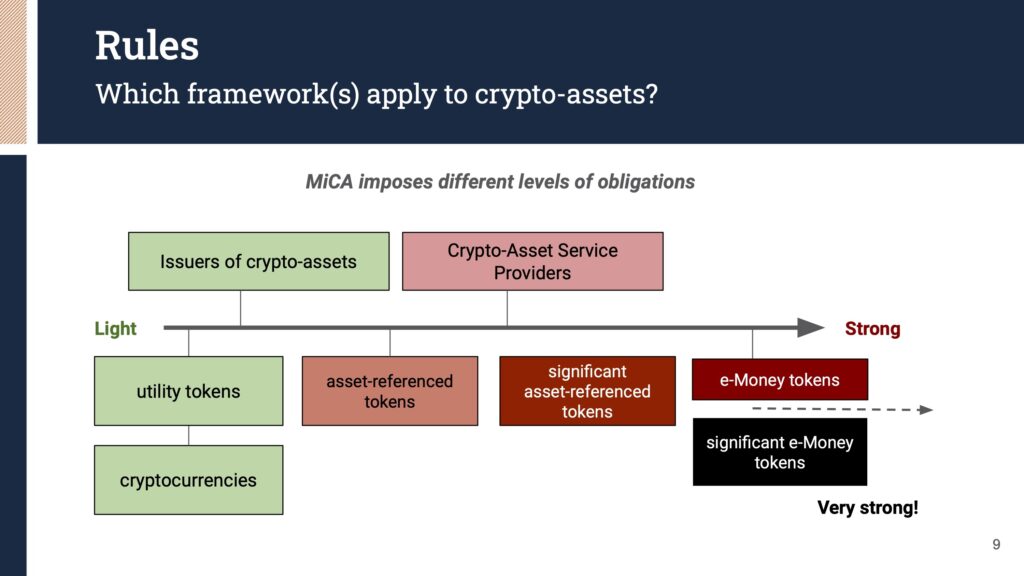

With these two texts, the Commission’s goal is to regulate crypto-asset players and not the assets as such.

MiCA

The draft MiCA regulation aims to regulate crypto-asset issuers and crypto-asset service providers (CASP). Crypto-assets include a wide range of digital assets, namely: cryptocurrencies, although not explicitly mentioned, utility tokens and stablecoins.

While provisions relating to crypto-asset issuance (excluding stablecoins) and providing crypto-asset-based services are based on the French ICO model and PSAN regime of the PACTE law – with the exception that European regulations will not be optional – the requirements for stablecoin issuance are completely new.

Stablecoin public offerings and their listing on trading platforms are prohibited unless the issuer complies with MiCA rules: legal persons, white paper, prudential requirements, prohibition on interest distribution, etc. Also, if a stablecoin qualifies as “significant” according to a list of established criteria, the issuer must comply with additional requirements to be authorised to distribute it.

The pilot regime for token security markets ✈️

Adan has long promoted the idea of a European Digital Lab that would allow the granting, under certain conditions, of exemptions from financial regulation for security tokens players. The industry has also voiced their support for such a Digital Lab, as shown in an Adan survey on security tokens carried out earlier this year.

The European Commission’s unveiling of its pilot regime for DLT Market Infrastructures is an initial step in this direction. It thus opens the possibility of exemptions from certain financial regulation requirements relating to trading and settlement-delivery of security token transactions. However, both the scope of the pilot scheme and the exemptions provided remains very limited.

A welcomed but limiting regime

While this regulatory project is encouraging, Adan nevertheless identifies four major risk areas for crypto innovation in Europe.

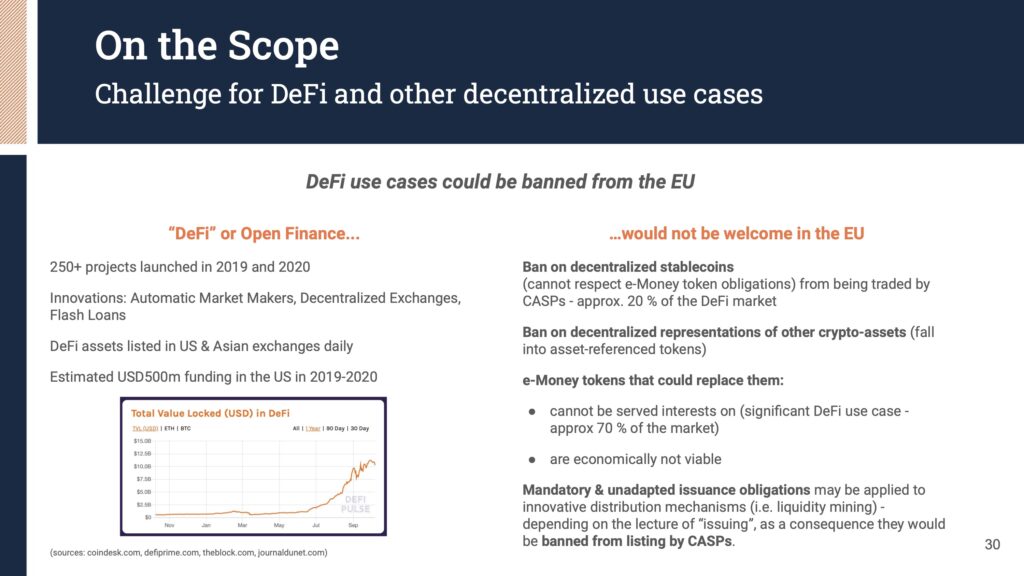

Risks for decentralised finance

In their current state, these texts would prohibit most innovative decentralised finance projects in Europe. This is the case for decentralised stablecoins (i.e. 20% of the DeFi market), other decentralised representations of crypto-assets, and any token that distributes interests to its holders. In particular, their decentralised nature will make it very difficult to comply with the obligations imposed on the issuance of crypto-assets.

The possible exclusion of public blockchain technologies

Certain provisions, particularly in the Pilot Regime framework, cast doubt on the possibility for actors to use public blockchains. Limiting innovation to the deployment of use cases on private networks would deprive the European Union of a true digital finance revolution, which is nevertheless advocated by the Commission.

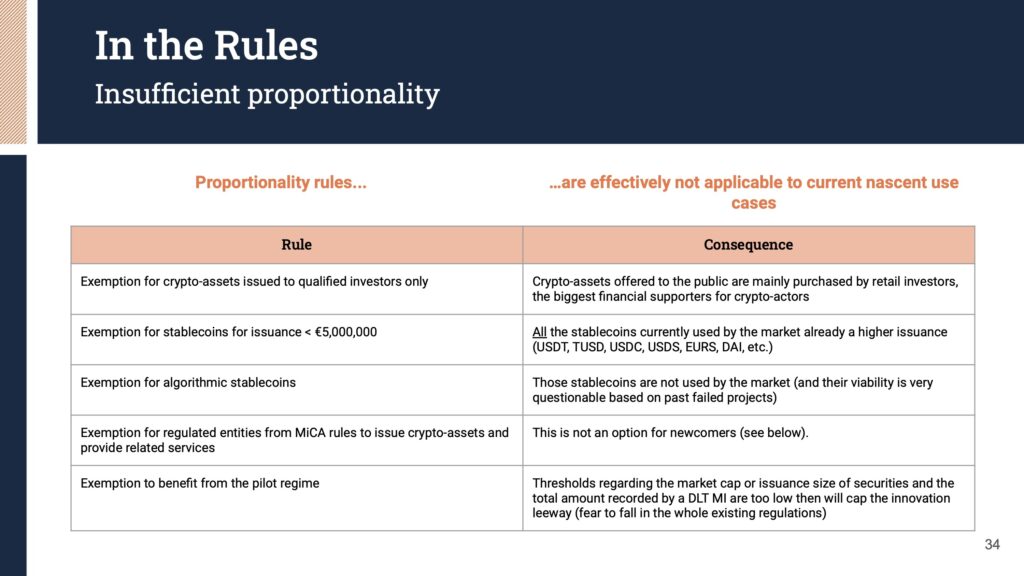

Proposed rules and exemptions lack proportionality

MiCA and PRR impose requirements and provide exemptions that are not always suitable for innovative players, as these requirements are disproportionate or these exemptions are unenforceable.

Preferential treatment for incumbent regulated entities at the expense of new entrants

On the one hand, established players benefit from numerous facilities for crypto-asset market access, through exemptions and equivalencies, relieving them of specific requirements and authorising their facto entry on these markets. But also, they are granted real monopolies, for example for the issuance of stablecoins qualified as e-money tokens, security tokens trading and settlement-delivery of security tokens transactions.

On the other hand, real obstacles block new entrants to crypto-assets markets. Procedures for obtaining authorisation are particularly long, certain obligations are disproportionate, and compliance costs are substantial for players with inferior financial resources.

Finally, the crypto-asset market would certainly deprive itself of its true potential for innovation, which is what new players bring with them.

Adan’s proposals for innovation

To remove these bottlenecks, allow start-ups to access the booming crypto-asset markets, and foster true innovation and competitiveness within the European Union, Adan proposes the following.

- Exclude decentralised crypto-assets from the scope of application

- Ensure that use cases may be deployed on public blockchains

- Introduce more proportionality in rules and exemptions, particularly regarding the size and seniority of industry players.

- Consider the value that new and existing payers in the crypto industry bring to the table, to restore equal opportunities in market development.

In the end, we must ask the essential question: How do we want to build the Europe of crypto-assets? By relying exclusively on the established players, forgetting those who have the finest knowledge of the industry and technology? Or do we want to give a chance for innovation to flourish and allow for creativity and new ways of thinking to enable the greatest potential for transformation?